November CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Today could be one of the most important economic data days of the year. We get to see the CPI report for November 2022. This report comes out at 8:30 AM ET and will give us a glimpse into the state of the consumer from a pricing perspective. Will it reflect Fed monetary policy in action, or, like that last Produce Price Index report, will it show inflation is not yet under control?

On this site, we typically discuss penny stocks, and we’ll also report on the biggest news stories of the day. Economic data is one of these topics. Moreover, we’ll also have the December Fed Meeting and FOMC announcement on Wednesday, along with the next Fed rate hike decision being made before the end of the year.

Tensions are already high as the market appeared blindsided by PPI results, bringing back fears of a more aggressive rate hike path for the Fed. The inflation numbers today should shed more light on the topic for speculators trying to put together the puzzle pieces ahead of tomorrow’s FOMC meeting.

The October CPI inflation report came in below estimates for both Core and overall CPI. It also extended the year’s declining CPI figures by another month and brought optimism back to investors.

Let’s go over some of the basics for those who may not be familiar with them and are asking questions like:

What is CPI data??

CPI Inflation Data vs. PPI Inflation Data & Why CPI is data critical to the stock market today

How can CPI inflation data be used in your investing and trading strategy?; and lastly

What are the results of the September CPI inflation report?

CPI Inflation Data & The CPI Report Defined

October CPI inflation data sparked some brief, bullish optimism heading into the end of the year. While volatility returned thanks to PPI results, the final CPI report of 2022 is the crown jewel for anyone hoping for a Santa Claus rally. If you’re new to economics or the stock market, you might not understand what CPI inflation data is or what to look for in the November CPI report.

What Is CPI Inflation Data? CPI stands for “Consumer Price Index.”

The U.S. Bureau of Labor Statistics explains it as“The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).”

– How to Conduct Due Diligence on Penny Stocks, 3 Tips

CPI data measures “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.”

October CPI Inflation Data

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 7.7% before seasonal adjustment.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. The energy index increased 1.8% over the month as the gasoline index and the electricity index rose, but the natural gas index decreased. The food index increased 0.6% over the month, with the food at home index rising 0.4%.

The index for all items less food and energy rose 0.3% in October after rising 0.6% in September. The indexes for shelter, motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Indexes which declined in October included the used cars and trucks, medical care, apparel, and airline fares indexes.

The all-items index increased 7.7% for the 12 months ending October; this was the smallest 12-month increase since the period ending January 2022. The all items less food and energy index rose 6.3% over the last 12 months. The energy index increased 17.6% for the 12 months ending October, and the food index increased 10.9% over the last year; all of these increases were smaller than for the period ending September.

November CPI Inflation Data Release Expectations

Let’s look at CPI and Core CPI expectations for November. The year-over-year CPI expectations for November are set at 7.3%, and month-over-month is expected to come in at 0.3%. This would be lower than October’s 7.7% and 0.4% CPI readouts. Core CPI is expected to come in at 6.1% year-over-year and 0.3% month-over-month for November. Year-over-year CPI would be slightly lower than October’s 6.3%, while month-over-month would be unchanged.

Consumer Price Index Report For November 2022 & CPI Numbers

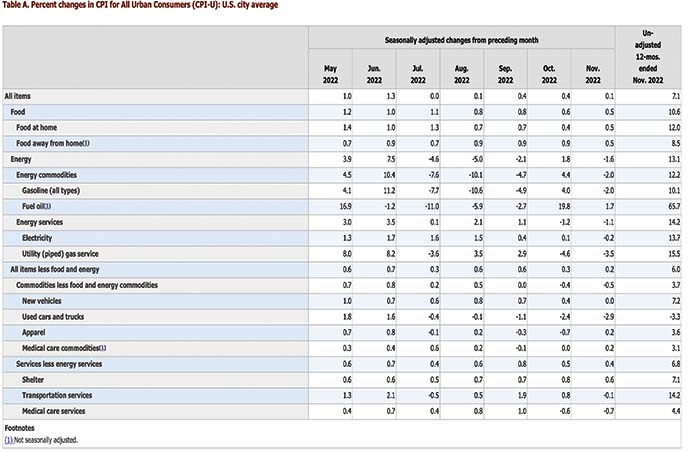

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.

The index for all items less food and energy rose 0.2 percent in November, after rising 0.3 percent in October. The indexes for shelter, communication, recreation, motor vehicle insurance, education, and apparel were among those that increased over the month. Indexes which declined in November include the used cars and trucks, medical care, and airline fares indexes.

The all items index increased 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index increased 13.1 percent for the 12 months ending November, and the food index increased 10.6 percent over the last year; all of these increases were smaller than for the period ending October.

Breaking Down The CPI Data: Key Takeaways

NOVEMBER CPI index increased 7.1% YoY & 0.1% MoM which were BELOW EXPECTATIONS

NOVEMBER CORE CPI index increased 6% YoY and 0.2% MoM which were BELOW EXPECTATIONS

The food index increased 0.5 percent in November following a 0.6-percent increase in October. The food at home index also rose 0.5 percent in November. Four of the six major grocery store food group indexes increased over the month.

The index for food away from home rose 8.5 percent over the last year. The index for full service meals rose 9.0 percent over the last 12 months, and the index for limited service meals rose 6.7 percent over the same period.

The energy index fell 1.6 percent in November after rising 1.8 percent in October. The gasoline index declined 2.0 percent over the month, following a 4.0-percent increase in October. (Before seasonal adjustment, gasoline prices fell 3.6 percent in November.) The index for natural gas continued to decline over the month, falling 3.5 percent after decreasing 4.6 percent in October. The electricity index decreased 0.2 percent in November.

The index for all items less food and energy rose 0.2 percent in November, its smallest increase since August 2021. The shelter index continued to increase, rising 0.6 percent over the month. The rent index rose 0.8 percent over the month, and the owners’ equivalent rent index rose 0.7 percent. The index for lodging away from home decreased 0.7 percent in November, after rising 4.9 percent in October.

The Stock Market Today

Immediately following the November CPI inflation data report, broader markets exploded to the upside, with major indexes ripping higher. The S&P 500 ETF (NYSE: SPY) climbing back above $400, The Nasdaq (NASDAQ: QQQ) tested $300, while the Dow’s (NYSE: DIA) briefly traded at $350 for the first time since April. Companies making headlines also saw amplified bullish trading action including Moderna (NASDAQ: MRNA), Oracle (NYSE: ORCL), and even beaten-down EV giant Tesla (NASDAQ: TSLA).

The market now eyes the conclusion. of the December FOMC meeting, the all-important FOMC press conference, and the last rate hike decision. of the year. Ideally, the market is looking for a 50 bps increase versus a 75 bps jump in rates.